Sales Tax Areas and Tax Entity Areas

- Category: Economy

- Data Type: GIS Data Layer

- Steward(s): USTC & AGRC

- Abstract: These datasets are related to taxation in Utah. They were created by the Utah State Tax Commission (USTC) and other local government agencies.

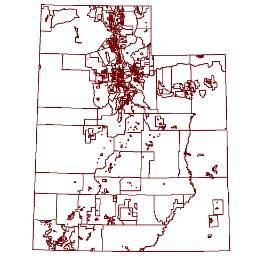

Sales Tax Areas

Economy.SalesTaxAreas contains the approximate boundaries of Sales Tax Collection Areas in Utah. Sales Tax Areas are formed by municipality boundaries, special sales tax districts and the unincorporated areas of counties not in a special sales tax district.

Related Resources

Comments, questions, compliments, or concerns can be directed to the staff from AGRC at agrc@utah.gov or 801-538-3665.

Downloads and Web Services

Updates

- Updated 1/31/2019 1st Quarter 2019

Tax Areas

Economy.TaxAreas2019 contains the set of taxing areas formed by each unique 2-dimensional intersection of incorporated taxing entities in Utah. Each taxing area represents at least a county and school district as members of these two categories cover the entire state. The property tax levy rate within a tax area should be the same for a specified property type within that area.

There are no constraints or warranties with regard to the use of this dataset.

Comments, questions, compliments, or concerns can be directed to the staff from AGRC at agrc@utah.gov or 801-538-3665.

Downloads and Web Services

Updates

- January 2020

Transit Special Tax Areas

Transit sales tax areas are generally areas outside of incorporated municipalities where additional sales tax is collected to support transit activities (generally buses).

Related Resources

Comments, questions, compliments, or concerns can be directed to Nick Kenczka from Tax at NKenczka@utah.gov.

Downloads and Web Services

Updates

- January 2019

- March 2018

Tax Entities

Economy.TaxEntities2019 contains Tax Entities in Utah. Tax Entities are incorporated bodies that have the power to levy a local property tax such as school districts, counties, cities, special service districts, redevelopment districts, library districts, cemetery districts, and mosquito abatement districts. Economy.TaxEntities2016 dataset does not represent exact legal boundaries, but rather a set of boundaries used for the administrative purposes by the USTC Property Tax Division for centrally assesses properties (quarries, rail, linear utilities, etc).

- ENT_NBR of

1010are counties 2000level ENT_NBR are school districts3000level ENT_NBR are incorporated cities/towns4000level ENT_NBR are special service districts6000level ENT_NBR are special districts8000and9000level ENT_NBR are redevelopment or community development areas (RDA or CDA)

Related Resources

Comments, questions, compliments, or concerns can be directed to Terri Chidester from Tax at TChidester@utah.gov.

Downloads and Web Services

Updates

- January 2020